नया GST बिल (GST 2.0) भारत में 📜🇮🇳

📑 Table of Contents

-

GST का परिचय – क्यों ज़रूरी था?

-

पुराने GST सिस्टम की समस्याएँ

-

New GST Bill 2025 (GST 2.0) – मुख्य बदलाव

-

नए Tax Slabs

-

Cheaper vs Costlier Items

-

-

Calculation Examples (पहले vs अब)

-

MSMEs और छोटे व्यवसाय पर असर

-

E-commerce और Startups पर असर

-

Agriculture और Rural Economy पर असर

-

राज्यों की सरकारों और Revenue Sharing पर असर

-

Common Man (आम जनता) पर असर

-

फायदे ✅ और चुनौतियाँ ⚠️

-

Future Roadmap (आगे क्या?)

-

निष्कर्ष

1. GST का परिचय – क्यों ज़रूरी था? 🤔

GST (Goods and Services Tax) ek indirect tax hai jo July 2017 me introduce hua. Pehle India me VAT, Excise Duty, Service Tax, Octroi, CST jaise multiple taxes the. Har state alag rate lagata tha, jiski wajah se “tax on tax” (cascading effect) hota tha.

GST ne ek one nation, one tax system create kiya. Lekin 2017 ke baad bhi kuch issues aaye jinki wajah se government ne ab New GST Bill (GST 2.0) introduce kiya hai.

2. पुराने GST सिस्टम की समस्याएँ 🛑

-

Bahut zyada tax slabs (0, 5, 12, 18, 28%) – complicated system.

-

Inverted duty structure – raw material par zyada tax, finished product par kam.

-

Har chhoti cheez ko alag-alag classify karna mushkil.

-

Compliance cost high – chhote vyapari aur MSMEs ke liye dikkat.

-

States aur Centre ke beech revenue sharing disputes.

3. New GST Bill 2025 (GST 2.0) – मुख्य बदलाव 🔄

Naye GST bill me simplification aur rationalisation par focus hai.

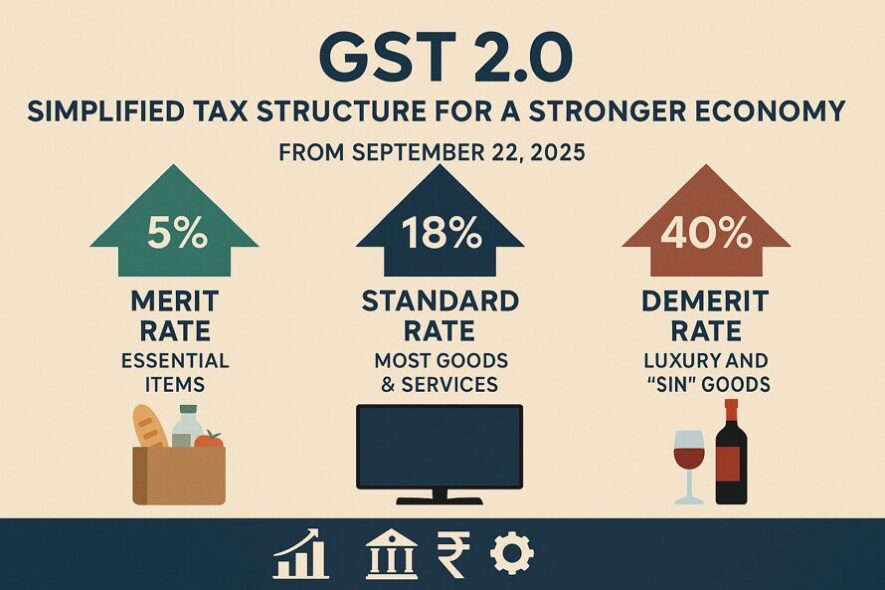

🎯 New GST Slabs

| Slab | Kis par lagega | Example |

|---|---|---|

| 0% | Essential items, life-saving drugs, education materials | Milk (UHT), Paneer, Books |

| 5% | Daily use items, FMCG products | Soap, Toothpaste, Hair Oil |

| 18% | Standard goods & services | TVs < 32”, Refrigerators, AC |

| 40% | Luxury + Sin Goods | Big Cars, Bikes >350cc, Cigarettes |

👉 Source: Times of India

🟢 सस्ती चीज़ें

-

रोजमर्रा की चीज़ें (toothpaste, soap, oil)

-

Dairy items (butter, ghee, paneer)

-

Education material (notebooks, pencils)

-

Small cars, small TVs, basic electronics

🔴 महँगी चीज़ें

-

Luxury cars & SUVs

-

High-end motorbikes (>350cc)

-

Cigarettes, Gutkha, Alcohol-type products

👉 Source: Hindustan Times

4. Calculation Examples 📊

| Product | Pehle (Old GST) | Ab (New GST 2.0) | Price Impact |

|---|---|---|---|

| Soap (₹100) | 18% = ₹118 | 5% = ₹105 | ₹13 सस्ता 🟢 |

| Small Car (₹5,00,000) | 28% = ₹6,40,000 | 18% = ₹5,90,000 | ₹50,000 सस्ता 🟢 |

| Luxury Car (₹20,00,000) | 28% = ₹25,60,000 | 40% = ₹28,00,000 | ₹2,40,000 महँगा 🔴 |

| Cigarette Pack (₹200) | 28%+Cess ≈ ₹260 | 40%+Cess ≈ ₹300 | ₹40 महँगा 🔴 |

5. MSMEs और छोटे व्यवसाय पर असर 🏭

-

Positive Impact:

-

Compliance easy, filing simple.

-

Low-cost goods (soap, notebook) पर demand बढ़ेगी → MSMEs ko फायदा.

-

Raw materials aur finished products ke tax rate mismatch kam hua.

-

-

Negative Impact:

-

Agar MSME luxury ya high-end products banate hain to demand gir sakti hai.

-

👉 Source: India Briefing

6. E-commerce aur Startups 📦💻

-

Online FMCG aur grocery platforms (Blinkit, Zepto, Amazon, Flipkart) → demand boost.

-

Consumer electronics (TV, fridge) par demand increase.

-

Luxury goods platforms → thoda hit.

-

Compliance rules simplified → Startups ke liye entry barriers kam.

7. Agriculture aur Rural Economy 🚜🌾

-

Fertilizers aur agri-tools par low tax → farmers ko राहत.

-

Dairy products (butter, paneer) par 0–5% → rural households benefitted.

-

Seeds aur khad par tax rationalisation se agriculture production cheap ho sakta hai.

8. राज्यों की सरकारें और Revenue Sharing 🏛️

-

Pehle GST se states ko compensation milta tha, ab naye slabs ke baad revenue कम हो सकता है.

-

कुछ states ne चिंता जताई hai कि unka share कम hoga.

-

FM ने आश्वासन दिया कि consumption बढ़ेga toh revenue automatically cover हो जाएगा.

👉 Source: PIB

9. Common Man (आम जनता) 👨👩👧👦

-

रोजमर्रा की चीज़ें सस्ती → middle & lower-income families ko राहत.

-

Education & health sector में राहत.

-

Luxury aspirational items महँगे ho gaye.

10. फायदे ✅ और चुनौतियाँ ⚠️

✅ फायदे

-

Simple tax structure

-

Common man ko relief

-

Consumption aur production growth

-

Inflation control

⚠️ चुनौतियाँ

-

Revenue shortfall

-

States vs Centre disputes

-

Luxury industry par negative impact

-

Implementation issues

11. Future Roadmap 🔮

-

सरकार चाहती है कि 3-4 साल में GST aur bhi simplified ho.

-

Digital GST platform → AI-based compliance.

-

International trade aur exports ko GST simplification se boost.

12. निष्कर्ष 🏁

New GST Bill 2025 (GST 2.0) ek game-changer reform hai.

Iska aim hai – “Simple GST, Sabke Liye GST”.

👉 आम जनता ke liye faydemand hai,

👉 Businesses aur MSMEs ke liye supportive hai,

👉 Lekin सरकार aur states ke liye revenue balancing ek बड़ी challenge hai.

अगर सही तरीके से implement हुआ तो ये बिल भारत के economic growth ko तेज़ कर सकता hai aur “$5 trillion economy” ke dream ko reality banane me मदद करेगा। 🇮🇳

🔗 External References: